This Blog is part of a series on COP29. The Conference of the Parties (COP) has become the focal point for global climate action, despite ongoing debates and skepticism. In this three-part series, we’ll examine COP29, focusing on climate diplomacy, finance, and the energy sector.

A blog by Moritz Pohl.

One of the central issues of COP29 was addressing the financial needs for mitigating both existing and future climate change challenges. Achieving the 1.5°C target and minimizing current global damages will require trillions of dollars annually. Although climate finance flows reached almost USD 1.3 trillion in 2021/2022 – almost double the 2019/2020 levels and representing roughly 1% of global GDP – these amounts are still insufficient. By 2030, the necessary annual climate finance is projected to rise from USD 8.1 trillion to USD 9 trillion, with demands increasing to over USD 10 trillion per year from 2031 to 2050. The World Economic Forum (WEF) estimates the total cost of the climate transition at USD 125 trillion by 2050.

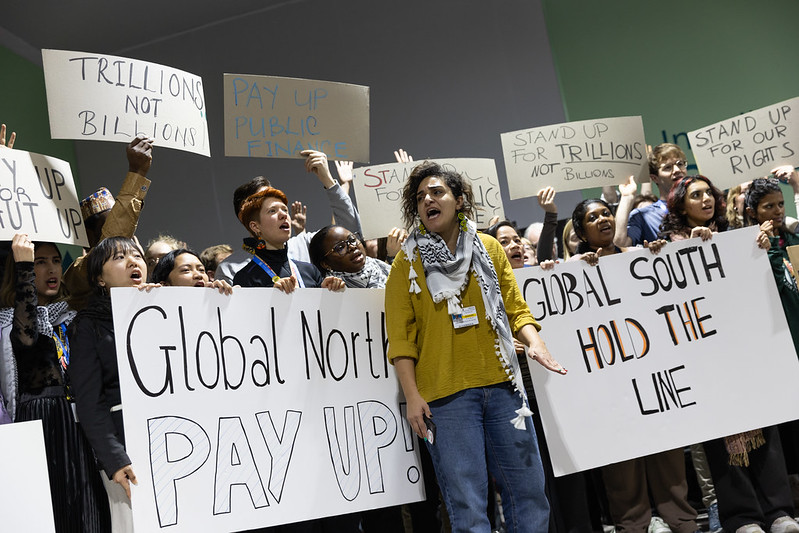

Growth in climate finance is not sufficient or evenly distributed across sectors and regions, especially for both mitigation and adaptation efforts. Most of the growth stems from increases in clean energy investment and is geographically concentrated in China, the U.S., Europe, Brazil, Japan and India. Many countries in the Global South are already severely affected by the impacts of climate change and need support to build sustainable and green economic growth. The OECD estimates that necessary funds for climate action in developing economies alone stand at approximately USD 2.4 trillion per year between now and 2030. Many of these countries are trapped in a cycle of debt and persistent poverty, while facing increasingly devastating climate impacts.

The EU recognizes the urgent need for climate action and is one of the largest supporters of global climate financing. This includes contributions from its Member States as well as from EU institutions. According to the European Commission, the EU allocated €28.6 billion in public climate funds and mobilized an additional €7.2 billion from private sources in 2023 to support developing countries in reducing greenhouse gas emissions and adapting to climate change , making the EU the largest contributor to global public climate finance.

New Collective Quantified Goal (NCQG)

At COP29, a New Collective Quantified Goal (NCQG) had to be adopted, as the previous one was fixed at 100 billion USD per year until 2025 and was achieved for the first time in 2022. However, the negotiations for the NCQG have been challenging. Disagreements persist on the total amount of funding, the timeline, and the review process. Many Global South nations and highly vulnerable island states pushed for USD 1.3 trillion in funding, while countries such as China and Saudi Arabia opposed higher contributions. Ultimately, the participating countries agreed on a target of at least USD 300 billion per year by 2035 to support poorer nations‘ climate efforts, which led to strong criticism from Global South countries. However, the demands of the Global South should not be confused with the Baku Finance Goal of USD 1.3 trillion, as these differ in their financing structure (total cost assumption by industrialised countries vs. globally cumulative financing flows).

Loss and Damage Fund

The Loss and Damage Fund, agreed upon at COP27 in Egypt, aims to provide financial support to countries most affected by climate change. At COP29 in Baku, the fund officially became operational, marking a historic step in addressing climate-related impacts in vulnerable countries. It will finance efforts to mitigate and adapt to climate-induced losses. The COP29 presidency highlighted the importance of mobilizing financial support and creating a transparent fund allocation mechanism. Over USD 730 million have been pledged, with projects set to begin in 2025.

Conclusion: Promises, Gaps, Inaction

The estimates for the cost of climate change highlight the urgent need for a rapid and adequate adjustment in climate financing. A climate finance gap will lead to higher long-term costs, both in terms of limiting global warming and addressing the damage caused by climate change. Support for the Global South is crucial, which is linked to the failure of the climate regime. Although setting a higher financing target is positive, the continued financing gap sends a message of uncertainty and inadequacy to Global South countries. After 2030, achieving 2050 climate goals will depend on the commercial adoption of decarbonization technologies, like hydrogen. Financing the green transition will be key to bridging this investment gap. Reaching climate mitigation goals will require scaling up private sector investments to meet these challenges.

*Due to the scope and available options for financing climate action, the author has selected a few key points. For further measures within this framework, see e.g.: COP29 – MDBs, WorldBank – MDBs, COP29 – Carbon Markets, CIF – CCMM, BICFIT

Moritz Pohl is an economic history masters student from the university of Göttingen. He obtained a bachelor’s degree in Management and Economics at the Ruhr-University Bochum and is one of the Co-Leads of the European Economic Policy Program of Polis180.

Editing by Eva Hager and Merritt Fedzin.

Image via Flickr

The Polis Blog serves as a platform at the disposal of ‘Polis180’s & ‘OpenTTN‘s members. Published comments express solely the ‘authors’ opinions and shall not be confounded with the opinions of the editors or of Polis180.

Zurück